What Is Section 179 and How Does It Help Me?

December 3, 2025

What Is Section 179 and How Does It Help Me?

Do you know what Section 179 is? Section 179 is a special tax incentive that can be used to buy medical equipment. In 2025, Section 179 allowed medical companies to write off up to $2,500,000.00 (a $1,280,000.00 increase from last year) off their taxes. The total cost of eligible equipment for this incentive is $4,000,000. For more information on this law, please look at the Section 179 website.

How it works?

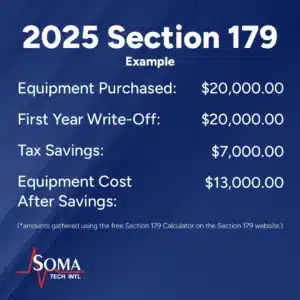

Section 179 allows businesses to deduct the full purchase price of qualifying equipment or software purchased or financed within a tax year. Instead of depreciating equipment over several years, companies can deduct the entire cost in the year it’s bought or leased. This incentive encourages businesses to invest in equipment and technology, benefiting both companies and the economy.

For example, over five years, a $20,000 machine might be deducted as $4,000 annually. With Section 179, the entire $20,000 can be deducted in the year of purchase, significantly improving cash flow.

Bonus Depreciation:

Bonus depreciation is another tool businesses can use to accelerate depreciation deductions by automatically applying a set percentage to all qualifying assets, with no spending cap. For 2025, the bonus depreciation allowed went up from 60% (in 2024) to 100% (in 2025). This provides flexibility to manage net operating costs. It’s ideal for significant investments that exceed the Section 179 limits. Using both Section 179 and Bonus Depreciation before 2025 ends can be a great financial tool for saving money during tax season.

Bonus Depreciation vs Section 179:

While in 2025, both seem to overlap, it is not usually the norm every year. In the years where the bonus depreciation is not 100%, you could only use Bonus Depreciation on a set percentage of the qualifying expenses. For example, in 2024, the rate was 60%, meaning that once businesses reached the Section 179 cap, they could only depreciate 60% of the remaining balance in the first year.

Main differences:

- Section 179:

- Defined maximin deduction ( $2,500,000.00 in 2025)

- Limited to your business taxable income and cannot generate a loss.

- Choose what qualifying assets to deduct.

- Special provisions for vehicles and software

- Bonus Depreciation:

- No dollar limit and a 100% deduction allowance on qualifying expenses.

- Can create or increase a net operating loss.

Two important details about Section 179:

- Immediate Deduction: Businesses can deduct the full purchase price of qualifying equipment on their current tax return (up to $2,500,000.00 for 2025).

- Eligibility: Equipment must be purchased or financed during the tax year and used for business (during that same year).

Benefits for Medical Facilities:

Medical providers can leverage Section 179 to upgrade or expand their equipment inventory. They can acquire capital medical equipment, such as patient monitors, ventilators, or surgical tables, while maximizing tax savings.

Types of Capital Medical Equipment

We offer a wide range of medical equipment. Soma Technology can outfit surgical centers, operating rooms, emergency rooms, clinics, and most equipment found in physicians’ offices. To browse our complete list of capital medical equipment, click here. Some of our popular product categories include ICU Equipment, C-arms, ultrasounds, stretchers, surgical tables, anesthesia machines, heart/coolers, NICU equipment, patient monitors, infusion pumps, tourniquets, ventilators, and many more.

Requesting Capital Medical Equipment From Our Sales Team

Our sales representatives are all highly versed in capital medical equipment. We can help with expansion projects, hospitals, clinics, and surgery centers, and DeNovo projects. Click here to find the sales representative that serves your region. Each sales rep can be reached at 1-800-438-7662 or by their direct line. They can also be emailed at soma@somatechnology.com. Call today, or email for a quote within 24 business hours!

Final Thoughts

Are you interested in taking advantage of this tax incentive? As a reminder, the deadline to engage in this program is December 31st, 2025.

Cool calculator!

Thank you William!